South East Senators, under the umbrella of the South East Senators’ Forum, have endorsed the need for wider consultations on the Tax Reform Bills being reviewed by the National Assembly.

The senators are calling for more engagement with various groups and stakeholders before the bills are fully considered and potentially passed by both chambers of the National Assembly.

Speaking to journalists on Monday in Abuja after a closed-door meeting with Senators from all five South-Eastern states, the leader of the caucus, Senator Enyinnaya Abaribe (APGA, Abia South), clarified that the senators are not opposed to the bills. Instead, they are advocating for more consultations on the bills before they move forward in the legislative process.

Abaribe stated, “As much as the entire South East Senators are not against the Tax Reform Bills before both chambers of the National Assembly, we want wider consultations to be carried out on them.”

He added that consultations should include engagement with constituents across the 15 Senatorial districts in the zone, as well as with state governments and other key stakeholders. “We have read through the bills and want to share our knowledge with other stakeholders from the South East Zone for a more equitable framework in the bills that will eventually be passed.”

The South East zone, comprising Abia, Anambra, Ebonyi, Enugu, and Imo states, has raised concerns about the bills’ potential impacts and is calling for a more inclusive review process.

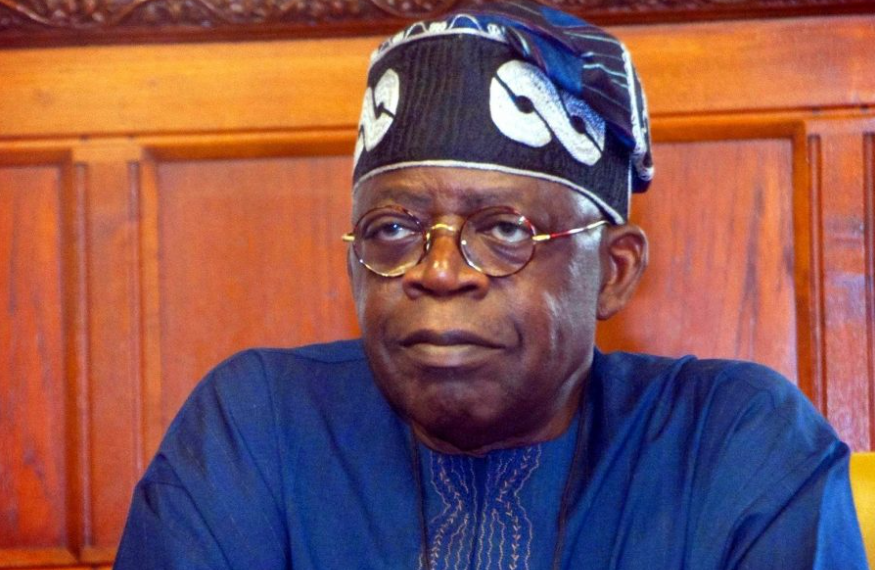

The Tax Reform Bills, which have sparked debates across the country, were sent to the National Assembly by President Bola Tinubu in October 2024. The bills are a result of recommendations from the Presidential Committee on Fiscal and Tax Reforms, chaired by Taiwo Oyedele, aimed at reviewing the existing tax laws.

Read also:Edun, projects positive economic outlook for Nigeria by 2025

The bills include the Nigeria Tax Bill 2024, which proposes a new fiscal framework for taxation, the Tax Administration Bill, which aims to provide clearer tax administration laws, and the Nigeria Revenue Service Establishment Bill, which seeks to repeal the Federal Inland Revenue Service Act and establish the Nigeria Revenue Service. The Joint Revenue Board Establishment Bill would create a tax tribunal and a tax ombudsman.

While the presidency and the South-South caucus in the Senate have pushed for the bills’ swift consideration, other stakeholders, such as the Nigeria Governors’ Forum (NGF), the Northern Senators, and the Arewa Consultative Forum, are calling for wider consultations before proceeding.

On October 3, 2024, President Tinubu transmitted the bills to the National Assembly for consideration. However, during a National Economic Council (NEC) meeting on the same day, it was resolved that the bills should be withdrawn for further consultation. In response, President Tinubu emphasized on October 31, 2024, that the bills should continue through the required legislative processes, which would include public hearings to allow Nigerians to provide feedback.

Vanguard.